Initiating Coverage | Auto Ancillary

November 15, 2018

Automotive Axles

BUY

CMP

`1250

Target Price

`1450

Established in 1981, Automotive Axles Limited (AAL) is a joint venture of

Investment Period

12 Months

Kalyani Group and Meritor Inc., USA. With manufacturing facilities located at

Mysore and Jamshedpur, the company manufactures drive axles, non-drive

Stock Info

axles, front steer axles, specialty & defense axles and drum & disc brakes.

Sector

Auto Ancillary

Increasing share of higher tonnage vehicles in CV segment to aid realizations:

Market Cap (` cr)

1,926

Given the improving infrastructure and implementation of GST, logistics sector is

witnessing a consolidation of warehouses, which in turn is building the Hub and

Beta

1.2

Spoke model to fulfil distribution solution. Further, improvement of road infra is

52 Week High / Low

1826/945

picking pace, which is expected to boost the demand for higher haulage tonne

Avg. Daily Volume

2,614

vehicles (especially for categories viz. >=44 tns & <=49 tns and above >=49 tns).

Face Value (`)

10

Marquee client base

BSE Sensex

35,142

AAL supplies axles and brakes to most of the OEMs and the company’s client base

Nifty

10,577

includes AMW, Ashok Leyland, Daimler, Escort, Mahindra & Mahindra, Sonalika, TATA

Reuters Code

ATOA.BO

Motors and Volvo. Ashok Leyland contributes significant part of AAL’s revenue (65%

Bloomberg Code

ATXL IN

in FY18); TATA Motors contributed 15% in FY18.

Capacity expansion to cater to increasing demand

AAL intends to increase its axle and breaks capacity by 40-45% over FY2019-20E in

Shareholding Pattern (%)

order to meet rising industry demand. Interestingly, the company’s current order

Promoters

71.1

book itself requires addition of 20-25% to the existing capacity. Currently, AAL has an

MF / Banks / Indian Fls

6.6

axle capacity of 16,500/month and brakes capacity of 85,000/month.

FII / NRIs / OCBs

1.7

Healthy revenue growth with improving product mix

AAL’s revenue has grown at CAGR of 20% over FY2014-18, which is above the

Indian Public / Others

20.6

industry growth due to increasing client base and improving content per vehicle

along with introduction of new products. The company’s ROE/ROCE has also

Abs.(%)

3m 1yr 3yr

improved significantly from 9%/7% in FY2014 to 28%/19% in FY18 respectively.

Outlook & Valuation: We believe AAL is comfortably placed to tap the upcoming

Sensex

(6.7)

12.6

37.2

opportunity in the industry owing to improving road infra, BS-VI pre-buying and

Automotive Axles

(2.1)

30.6

83.7

foray into new segment coupled with expansion of capacity by 35-40%. At the CMP

of Rs1,250, the stock is available at 12.3x its FY2020E EPS of Rs96. We have assigned a

multiple of 15x and recommend BUY on AAL with a target price of Rs1,450, implying

an upside of 16% over the next 9-12 months.

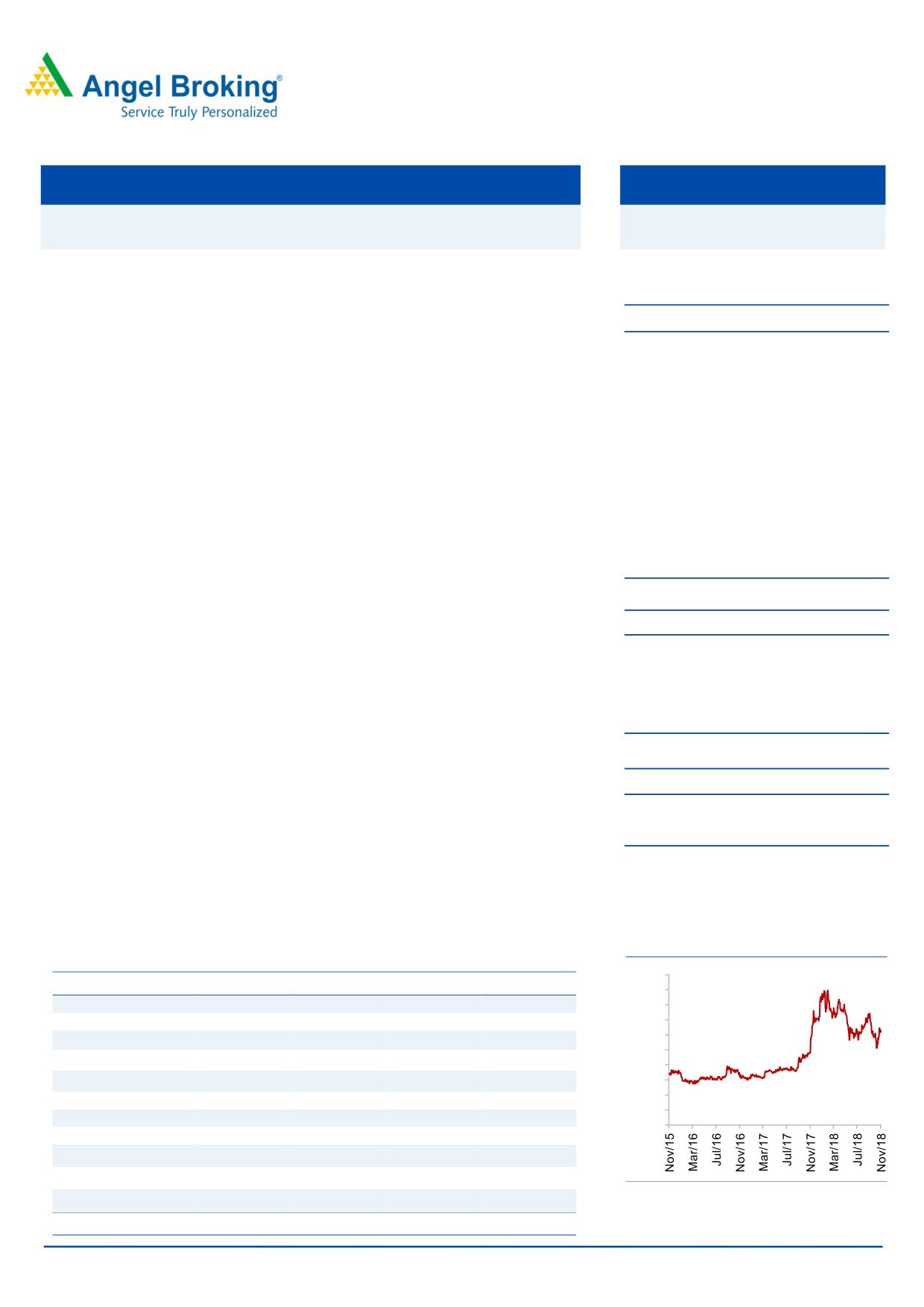

3-year price chart

Key Financial

2000

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

1800

Net Sales

1,172

1,519

2,095

2,618

1600

% chg

8

30

38

25

1400

1200

Net Profit

49

84

111

146

1000

% chg

42

70

69

6

800

EBITDA (%)

9.7%

11.0%

10.7%

10.7%

600

400

EPS (Rs)

33

56

74

97

200

P/E (x)

38

23

17

13

0

P/BV (x)

5.0

4.3

3.5

2.9

RoE (%)

13.1

18.9

20.7

22.2

RoCE (%)

19.7

27.9

28.8

29.7

Source: Capitaline, Angel Research

EV/EBITDA

16.3

11.0

8.0

6.2

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Automotive Axles | Initiating Coverage

Company Background

Established in 1981, Automotive Axles Limited (AAL) is a joint venture of Kalyani Group

and Meritor Inc., USA. With manufacturing facilities located at Mysore (Karnataka) and

Jamshedpur (Jharkhand), the company manufactures drive axles, non-drive axles, front

steer axles, specialty & defence axles and drum & disc brakes. It provides these

products to major domestic and global manufacturers of trucks & buses pertaining to

segments such as light, medium & heavy commercial vehicles, military & off-highway

vehicles, aftermarket and exports. As a continuous process, the company believes in

introducing new products regularly in order to meet the emerging needs of the

commercial vehicle market.

About JV with Meritor

The products manufactured by AAL are based on technology provided by the parent

Meritor Inc., USA. The technology transfer by Meritor Inc. is routed through its 51%

subsidiary in India - Meritor HVS (India) Limited (MHVSIL). MHVSIL is also responsible

for customer sourcing, interaction and marketing for AAL, with almost the entire sales

of AAL routed through MHVSIL. MHVSIL is 51:49 JV between Meritor International,

USA and Bharat Forge with Meritor holding majority stake. AAL manufactures and sells

axles, components, brake components and subassemblies to MHVSIL, which in turn

sells it to the end customer.

Management details

Dr. N Muthukumar - President & Whole Time Director

Dr. Muthukumar is the President and Whole Time Director of Automotive Axles

Limited, Mysuru. He joined AAL in 2008 as GM operations and currently heads India

Operations & Exports and Off-highway Military business. He has rich experience of

more than 28 years in the Automobile and Pharmaceutical sectors. He commenced his

career with TVS Srichakra Tyres as Management Trainee in 1987 and became Head of

Manufacturing Systems in the same organization by 1994. In 1998 he headed the

Business Process Re-engineering in TVS group and post successful completion

became Head Operations for Sundaram Industries Limited. He then moved to the TTK

Group, running their International Business for about

6 years before joining

Automotive Axles Limited.

Mr. Ranganathan S - Chief Financial Officer

Mr. Ranganathan Sankaran is a qualified Chartered Accountant and Cost & Works

Accountant. Ranganathan has around 21 years of work experience and joined

Automotive Axles Limited from Circor Flow Technologies India Pvt Ltd., Coimbatore,

where he was designated as Country Controller and Director - Finance. Earlier to this

he worked with Brady Company India Pvt. Ltd. as General Manager - Finance, Makino

India Private Ltd as General Manager - Finance and Director, Faurecia Automotive

Seating India Ltd, and Motorola India Ltd.

Industry outlook

The Indian automotive industry has been able to create a strong domestic and

international market, with policy support from the Government. The Indian

Government aims to develop India as a global manufacturing centre coupled with

November 15, 2018

2

Automotive Axles | Initiating Coverage

building an innovative R&D hub and it’s Automotive Mission Plan: 2016-26 are a boost

for the industry. We expect demand growth to pick-up due to favorable

demographics, rising disposable incomes, thrust on Make in India initiative,

abundance of skilled labor and improved access to finance. A series of reforms,

including demonetization, implementation of Bharat Stage-IV (BS-IV) emission norms,

implementation of GST and enforcement of overloading norms, have resulted in

significant volatility in the purchase considerations of fleet operators, influencing the

demand for Commercial Vehicles (CVs). Industry is witnessing progress with new

products and advanced technologies entering India through joint ventures,

partnerships and acquisitions, due to which the quality and cost competitiveness of

Indian auto components is improving steadily. Moreover, automobile exports from

India are also on the rise. Lower production costs and significant cost advantages are

making India an attractive outsourcing hub, leading to domestic companies’

significantly increasing production capacities.

Further, execution of GOI’s ambitious umbrella programme “Bhartmala Pariyojana”

which will improve connectivity of major economic corridors may help to move 80% of

freight traffic to national highways from 40% currently.

Manufacturing capabilities

With manufacturing facilities located at Mysore, AAL is currently one of the largest

independent manufacturers of Rear Drive Axle Assemblies. With more than 30 years of

axle producing experience and advanced gearing technology from Meritor HVS (India)

Ltd., it has been manufacturing reliable & long-life light, medium & heavy duty drive

axles, front steer axles, non-drive axles, axles for defence & off-highway applications

and drum & disc brakes. The marketing & field service support is provided by Meritor

HVS (India) Ltd.

Product offerings

Axles

Axles are used to transmit the driving torque to the wheel and help maintain the

position of the wheels. Axles also bear the weight of the vehicle as well as the cargo.

There are three types of axles viz. (a) beam axle (front axle), (b) drive axle (mostly rear),

(c) front axles.

Exhibit 1: Defence & off-highway axle

Source: Company, Angel Research

November 15, 2018

3

Automotive Axles | Initiating Coverage

Exhibit 2: Drive axle

Source: Company, Angel Research

Exhibit 3: Front axle

Source: Company, Angel Research

Exhibit 4: Brakes

Source: Company, Angel Research

Brakes

A brake is a mechanical device that inhibits motion by absorbing energy from a

moving system. It is used for slowing or stopping a moving vehicle, wheel, axle, or to

prevent its motion, most often accomplished by means of friction.

Investment Argument

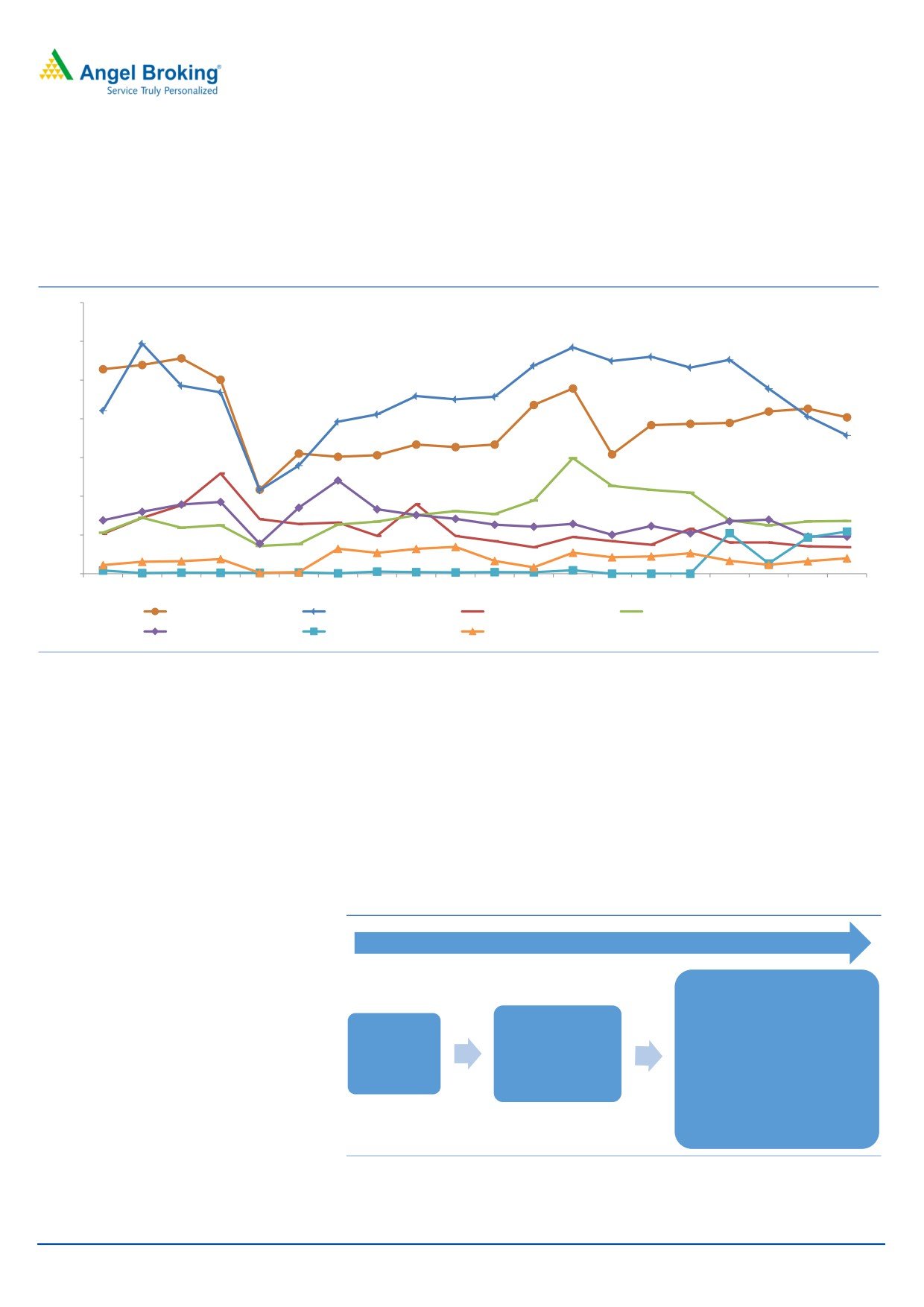

Increasing share of higher tonnage vehicles in CV segment to aid realizations:

Given the improving infrastructure and implementation of GST, logistics sector is

witnessing a consolidation of warehouses, which in turn is building the Hub and Spoke

November 15, 2018

4

Automotive Axles | Initiating Coverage

model to fulfill distribution solution. Further, improvement of road infra is picking

pace, which is expected to boost the demand for higher haulage tonne vehicles,

especially for categories viz. >=44 tns & <=49 tns and above >=49 tns (refer exhibit

5). The increased share of higher tonnage vehicle i.e. >=44 tns & <=49 tns and above

>=49 tns categories is visible from March 2018.

Exhibit 5: Vehicle share in MH&CV segments

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

Dec-16

Jan-17

Feb-17 Mar-17 Apr-17 May-17

Jun-17

Jul-17

Aug-17 Sep-17

Oct-17 Nov-17 Dec-17

Jan-18

Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18

>=16.2 tns & <=25 tns Total

>=25 tns Total

>=26.4 tns & <=35.2 tns Total

>=35.2 tns & <=40 tns Total

>=40 tns & <=49 tns Total

>=44 tns & <=49 tns Total

>=49 tns Total

Source: Company, Angel Research

Changing industry dynamics

Indian auto industry is anticipated to change significantly from current levels

considering the increasing parameters of safety, emission norms, load carrying

capacity, GPS navigation, etc. We believe these changes will require immediate

adoption of technological shift, and hence, OEMs will prefer to work with suppliers

who have global standard technological edge like Automotive Axles. Introduction of

new technologies like automatic emergency braking, pedestrian recognition,

independent suspension technologies and electronic controlled air.

Exhibit 6: Changing industry dynamics

Before 2018

-

2018

-

2020-2030

EBS/ Disc brakes - automatic

emergency braking, pedestrian

Disc/ABS/Exhaust

recognition, independent

Drum

Brakes/Air

suspension technologies,

braking &

suspensions,

electronic controlled air

shocks

hydraulic

suspensions. (Electronically

suspension.

controlled shocks offering

superior ride comfort for driver

and cargo.

Source: Angel Research

November 15, 2018

5

Automotive Axles | Initiating Coverage

Old vehicle scrap policy and Pre-Buying before BS-VI

We believe implementation of BS-VI norms which is expected to be kick in from April

2020 will trigger pre buying of BS-IV vehicles owing to costlier BS-VI vehicle post

implementation of said norms. Furthermore, Vehicle scrap policy which is under

consultation with stakeholders, if implemented from April 2020 then these will support

additional demand for vehicles.

Foray in to suspension segments

AAL looking to increase content per vehicle going forward, in order to achieve the

same AAL has launched new slip suspension system with technical collaboration from

Brazilian firm. The new suspension is in advance stage to supply the same to Ashok

Leyland. As per the management, slip suspension will increase life of tyres by up to 20-

25% and also improve ride quality.

Marquee client base

AAL supplies axles and brakes to most of the OEMs and the company’s client base

includes AMW, Ashok Leyland, Daimler, Escort, Mahindra & Mahindra, Sonalika, TATA

Motors and Volvo. Ashok Leyland contributes significant part of AAL’s revenue (65% in

FY18); TATA Motors contributed 15% in FY18.

Capacity expansion to cater to increasing demand

AAL intends to increase its axle and breaks capacity by 40-45% over FY2019-20E in

order to meet rising industry demand. Moreover, the company’s current order book

itself requires addition of 20-25% to the existing capacity. Currently, AAL has an axle

capacity of 16,500/month, which it intends to increase to 24,000/month in a phased

manner over 12-18 months. Moreover, in brakes it is already running at full capacity

and intends to increase the capacity from 85,000/month to 1,25,000/month units

during the same period. The part of expansion will be done in its existing Mysore plant

and upcoming plant in Pitampura, for which AAL has already acquired the land.

Healthy revenue growth with improving product mix

AAL has registered revenue CAGR of 20% over FY2014-18, which is above the industry

growth due to increasing client base and improving content per vehicle along with

introduction of new products. AAL’s ROE/ROCE has also improved significantly from

9%/7% in FY2014 to 28%/19% in FY2018 respectively. We believe introduction of

suspension products and increasing presence in after market segments will help AAL

maintain industry revenue growth going forward.

Outlook & Valuation: We believe AAL is comfortably placed to tap the upcoming

opportunity in the industry owing to improving road infra, BS-VI pre-buying and foray

into new segment coupled with expansion of capacity by 35-40%. At the CMP of

Rs1,250, the stock is available at 12.3x its FY2020E EPS of Rs96. We have assigned a

multiple of 15x and recommend BUY on AAL with a target price of Rs1,450, implying

an upside of 16% over the next 9-12 months..

Risk Factor:

Slowdown in CV segments may impact profitability.

November 15, 2018

6

Automotive Axles | Initiating Coverage

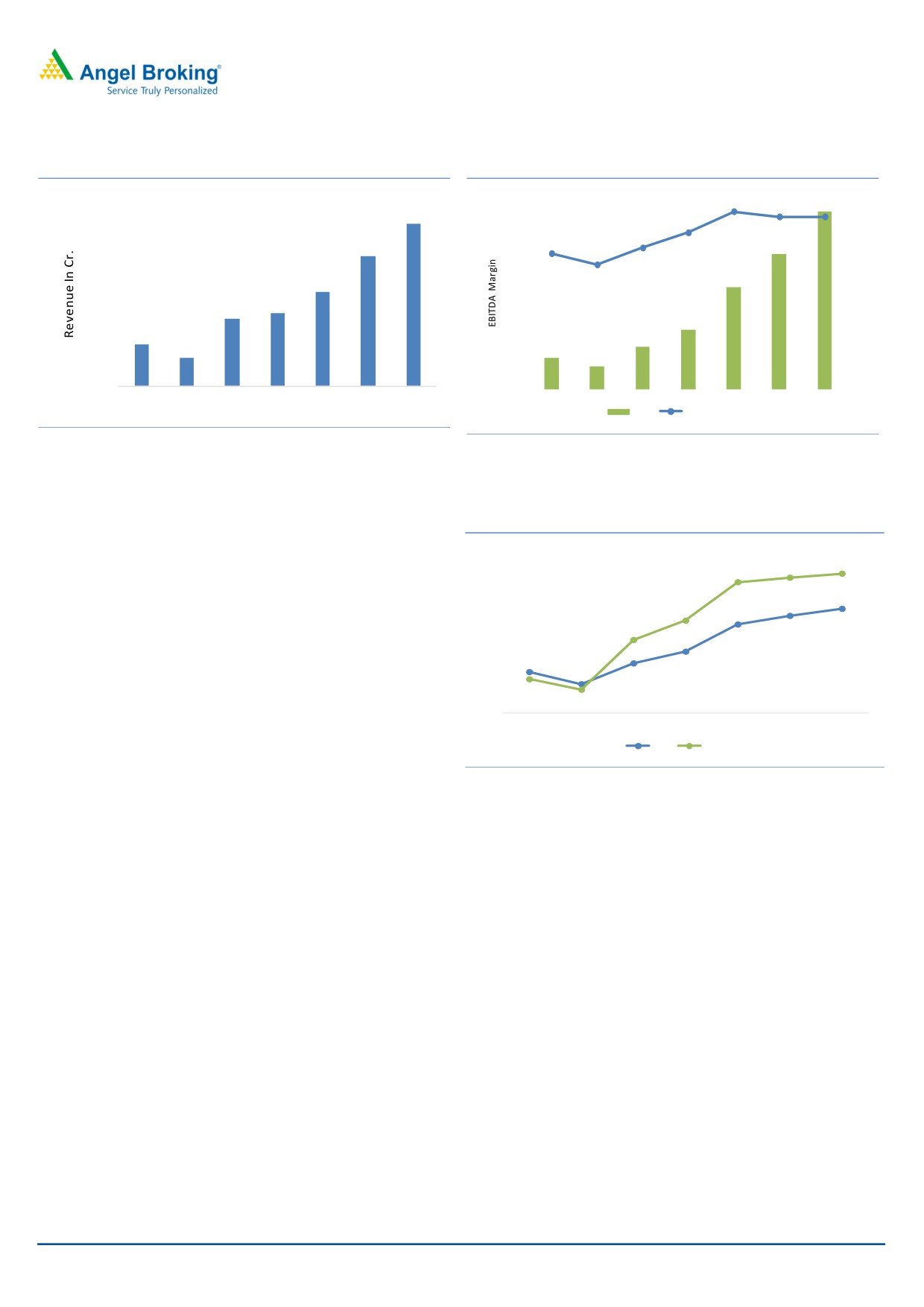

Exhibit 7: Revenue grown at 22% over FY14 to FY18

Exhibit 8: PAT and Margin trend

12%

160

3000

11%

11%

11%

140

10%

2500

10%

120

9%

8%

2000

8%

8%

100

1500

6%

80

60

1000

4%

40

500

2%

20

0

0%

0

FY14

FY15

FY16

FY17

FY18

FY19E FY20E

PAT

EBIDTA Margin

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 9: Return Ratio

35%

30%

30%

29%

28%

25%

22%

20%

21%

20%

19%

15%

16%

13%

10%

11%

9%

7%

6%

5%

5%

0%

FY14

FY15

FY16

FY17

FY18

FY19E

FY20E

ROE

ROCE

Source: Company, Angel Research

November 15, 2018

7

Automotive Axles | Initiating Coverage

Income Statement

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

Total operating income

1,172

1,519

2,095

2,618

% chg

8

30

38

25

Total Expenditure

1,059

1,352

1,872

2,339

Raw Material

826

1,079

1,467

1,833

Personnel

81

99

126

157

Selling and Administration Expenses

21

23

34

42

Others Expenses

130

151

246

307

EBITDA

114

167

224

279

% chg

20

47

34

25

(% of Net Sales)

9.7%

11.0%

10.7%

10.7%

Depreciation& Amortisation

39

43

54

51

EBIT

74

124

169

228

% chg

33

67

37

35

(% of Net Sales)

6

8

8

9

Interest & other Charges

1

1

5

11

Other Income

2

5

5

5

Recurring PBT

75

128

169

223

% chg

46

70

33

32

Tax

26

44

58

77

PAT (reported)

49

84

111

146

% chg

42

70

33

32

(% of Net Sales)

4.2

5.5

5.3

5.6

Basic & Fully Diluted EPS (Rs)

33

56

74

97

% chg

42

70

33

32

Source: Company, Angel Research

November 15, 2018

8

Automotive Axles | Initiating Coverage

Balance Sheet

Y/E March (`cr)

FY17

FY18

FY19E

FY20E

SOURCES OF FUNDS

Equity Share Capital

15.1

15.1

15.1

15.1

Reserves& Surplus

361

429

522

644

Shareholders Funds

377

444

537

659

Total Loans

-

-

51

111

Other Liabilities

3

2

0

0

Total Liabilities

379

446

588

769

APPLICATION OF FUNDS

Net Block

146

118

125

116

Capital Work-in-Progress

7

17

17

10

Investments

-

6

8

10

Long Term Loans & Advances

15

21

21

20

Current Assets

393

570

801

1,090

Inventories

99

137

172

201

Sundry Debtors

231

350

476

574

Cash

35

44

150

260

Loans & Advances

1

1

1

1

Investments & Others

27

37

2

55

Current liabilities

182

285

384

478

Net Current Assets

211

285

417

613

Other Non Current Asset

-

-

-

-

Total Assets

379

446

588

769

Source: Company, Angel Research

November 15, 2018

9

Automotive Axles | Initiating Coverage

Cash flow

Y/E March (`cr)

FY17

FY18

FY19E

FY20E

Profit before tax

75

128

169

223

Depreciation

39

43

54

51

Change in Working Capital

(35)

81

4

(33)

Interest / Dividend (Net)

1

1

5

11

Direct taxes paid

26

44

58

77

Others

(9)

(245)

(138)

(86)

Cash Flow from Operations

97

51

153

242

(Inc.)/ Dec. in Fixed Assets

(23)

(30)

(49)

(39)

(Inc.)/ Dec. in Investments

1

3

(2)

(2)

Cash Flow from Investing

(23)

(27)

(51)

(41)

Issue of Equity

-

-

-

-

Inc./(Dec.) in loans

-29

-

51

60

Others

(11)

(15)

(47)

(151)

Cash Flow from Financing

(40)

(15)

4

(91)

Inc./(Dec.) in Cash

35

9

106

110

Opening Cash balances

0

35

44

150

Closing Cash balances

35

44

150

260

Source: Company, Angel Research

Key Ratios

Y/E March

FY17

FY18

FY19E

FY20E

P/E (on FDEPS)

38

23

17

13

P/CEPS

17

11

8

7

P/BV

5

4

4

3

EV/Sales

2

1

1

1

EV/EBITDA

16

11

8

6

EV / Total Assets

3

3

2

1

Per Share Data (Rs)

EPS (Basic)

33

56

74

97

EPS (fully diluted)

33

56

74

97

Cash EPS

75

113

147

180

DPS

8

14

14

14

Book Value

249

294

355

436

Returns (%)

ROCE

20

28

29

30

Angel ROIC (Pre-tax)

22

33

41

47

ROE

13

19

21

22

Turnover ratios (x)

Inventory / Sales (days)

31

33

30

28

Receivables (days)

72

84

83

80

Payables (days)

53

62

60

60

Working capital cycle (ex-cash) (days)

50

55

53

48

Source: Company, Angel Research

November 15, 2018

10

Automotive Axles | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Company Name

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

November 15, 2018

11